Page 25 - ENGLISH_Land

P. 25

2.2.2 Retail

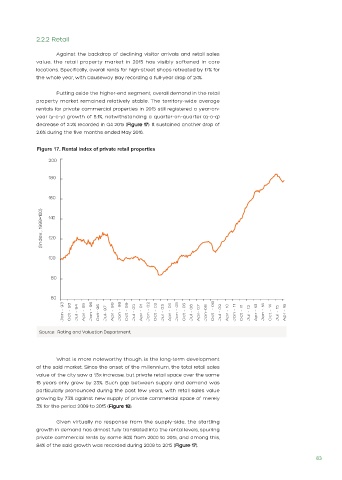

Against the backdrop of declining visitor arrivals and retail sales

value, the retail property market in 2015 has visibly softened in core

locations. Specifically, overall rents for high-street shops retreated by 17% for

the whole year, with Causeway Bay recording a full-year drop of 24%.

Putting aside the higher-end segment, overall demand in the retail

property market remained relatively stable. The territory-wide average

rentals for private commercial properties in 2015 still registered a year-on-

year (y-o-y) growth of 5.1%, notwithstanding a quarter-on-quarter (q-o-q)

decrease of 2.2% recorded in Q4 2015 (Figure 17). It sustained another drop of

2.6% during the five months ended May 2016.

Figure 17. Rental index of private retail properties

200

180

160

(Index , 1999=100) 140

120

100

80

60

Jan - 93 Oct - 93 Jul - 94 Apr - 95 Jan - 96 Oct- 96 Jul- 97 Apr - 98 Jan - 99 Oct - 99 Jul - 00 Apr - 01 Jan - 02 Oct - 02 Jul - 03 Apr - 04 Jan - 05 Oct - 05 Jul - 06 Apr- 07 Jan-08 Oct - 08 Jul - 09 Apr - 10 Jan - 11 Oct - 11 Jul - 12 Apr - 13 Jan - 14 Oct - 14 Jul - 15 Apr - 16

Source: Rating and Valuation Department.

What is more noteworthy though, is the long-term development

of the said market. Since the onset of the millennium, the total retail sales

value of the city saw a 1.5x increase, but private retail space over the same

15 years only grew by 23%. Such gap between supply and demand was

particularly pronounced during the past few years, with retail sales value

growing by 73% against new supply of private commercial space of merely

3% for the period 2009 to 2015 (Figure 18).

Given virtually no response from the supply-side, the startling

growth in demand has almost fully translated into the rental levels, spurring

private commercial rents by some 80% from 2000 to 2015, and among this,

84% of the said growth was recorded during 2009 to 2015 (Figure 17).

83