Page 45 - ENGLISH_FullText

P. 45

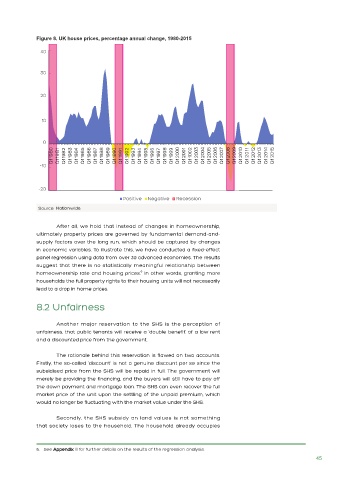

Figure 8. UK house prices, percentage annual change, 1980-2015

Source: Nationwide.

After all, we hold that instead of changes in homeownership,

ultimately property prices are governed by fundamental demand-and-

supply factors over the long run, which should be captured by changes

in economic variables. To illustrate this, we have conducted a fixed-effect

panel regression using data from over 30 advanced economies. The results

suggest that there is no statistically meaningful relationship between

6

homeownership rate and housing prices. In other words, granting more

households the full property rights to their housing units will not necessarily

lead to a drop in home prices.

8.2 Unfairness

Another major reservation to the SHS is the perception of

unfairness, that public tenants will receive a ‘double benefit’ of a low rent

and a discounted price from the government.

The rationale behind this reservation is flawed on two accounts.

Firstly, the so-called ‘discount’ is not a genuine discount per se since the

subsidised price from the SHS will be repaid in full. The government will

merely be providing the financing, and the buyers will still have to pay off

the down payment and mortgage loan. The SHS can even recover the full

market price of the unit upon the settling of the unpaid premium, which

would no longer be fluctuating with the market value under the SHS.

Secondly, the SHS subsidy on land values is not something

that society loses to the household. The household already occupies

6. See Appendix III for further details on the results of the regression analysis.

45