Page 79 - ENGLISH_FullText

P. 79

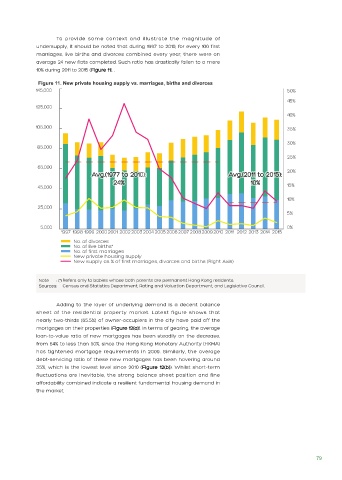

To provide some context and illustrate the magnitude of

undersupply, it should be noted that during 1997 to 2010, for every 100 first

marriages, live births and divorces combined every year, there were on

average 24 new flats completed. Such ratio has drastically fallen to a mere

10% during 2011 to 2015 (Figure 11). .

Figure 11. New private housing supply vs. marriages, births and divorces

Note : (*) Refers only to babies whose both parents are permanent Hong Kong residents.

Sources: Census and Statistics Department, Rating and Valuation Department, and Legislative Council.

Adding to the layer of underlying demand is a decent balance

sheet of the residential property market. Latest figure shows that

nearly two-thirds (65.5%) of owner-occupiers in the city have paid off the

mortgages on their properties (Figure 12(a)). In terms of gearing, the average

loan-to-value ratio of new mortgages has been steadily on the decrease,

from 64% to less than 50%, since the Hong Kong Monetary Authority (HKMA)

has tightened mortgage requirements in 2009. Similarly, the average

debt-servicing ratio of these new mortgages has been hovering around

35%, which is the lowest level since 2010 (Figure 12(b)). Whilst short-term

fluctuations are inevitable, the strong balance sheet position and fine

affordability combined indicate a resilient fundamental housing demand in

the market.

79