Page 84 - ENGLISH_FullText

P. 84

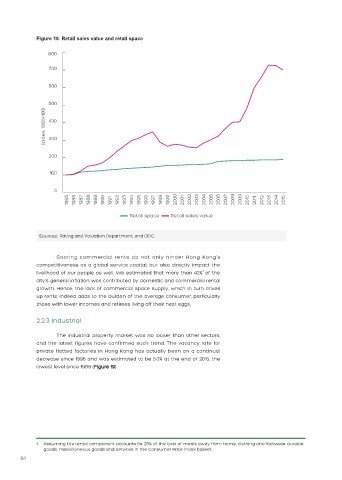

Figure 18. Retail sales value and retail space

Sources: Rating and Valuation Department, and CEIC.

Soaring commercial rents do not only hinder Hong Kong’s

competitiveness as a global service capital, but also directly impact the

1

livelihood of our people as well. We estimated that more than 40% of the

city’s general inflation was contributed by domestic and commercial rental

growth. Hence, the lack of commercial space supply, which in turn drives

up rents, indeed adds to the burden of the average consumer, particularly

those with lower incomes and retirees living off their nest eggs.

2.2.3 Industrial

The industrial property market was no looser than other sectors,

and the latest figures have confirmed such trend. The vacancy rate for

private flatted factories in Hong Kong has actually been on a continual

decrease since 1996 and was estimated to be 5.0% at the end of 2015, the

lowest level since 1988 (Figure 19).

1. Assuming the rental component accounts for 25% of the cost of meals away from home, clothing and footwear, durable

goods, miscellaneous goods and services in the Consumer Price Index basket.

84