Page 80 - ENGLISH_FullText

P. 80

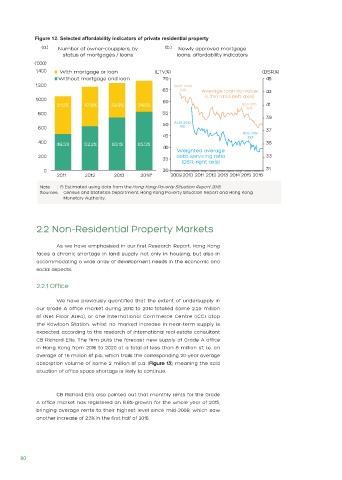

Figure 12. Selected affordability indicators of private residential property

Note : (*) Estimated using data from the Hong Kong Poverty Situation Report 2015.

Sources: Census and Statistics Department, Hong Kong Poverty Situation Report and Hong Kong

Monetary Authority.

2.2 Non-Residential Property Markets

As we have emphasised in our first Research Report, Hong Kong

faces a chronic shortage in land supply not only in housing, but also in

accommodating a wide array of development needs in the economic and

social aspects.

2.2.1 Office

We have previously quantified that the extent of undersupply in

our Grade A office market during 2010 to 2014 totalled some 2.25 million

sf (Net Floor Area), or one International Commerce Centre (ICC) atop

the Kowloon Station, whilst no marked increase in near-term supply is

expected, according to the research of international real estate consultant

CB Richard Ellis. The firm puts the forecast new supply of Grade A office

in Hong Kong from 2016 to 2020 at a total of less than 8 million sf, i.e. an

average of 1.6 million sf p.a., which trails the corresponding 20-year average

absorption volume of some 2 million sf p.a. (Figure 13), meaning the said

situation of office space shortage is likely to continue.

CB Richard Ellis also pointed out that monthly rents for the Grade

A office market has registered an 8.8%-growth for the whole year of 2015,

bringing average rents to their highest level since mid-2008, which saw

another increase of 2.3% in the first half of 2016.

80