Page 51 - OHKF_Biotech_EN

P. 51

Many governments also provide enterprises with The above suggestions regarding taxation and rents are

government-guaranteed low-interest loans. Launched in 2011 summarised below (see Table 6):

by the Hong Kong SAR Government, the SME Financing

Guarantee Scheme aims to help local SMEs and non-listed

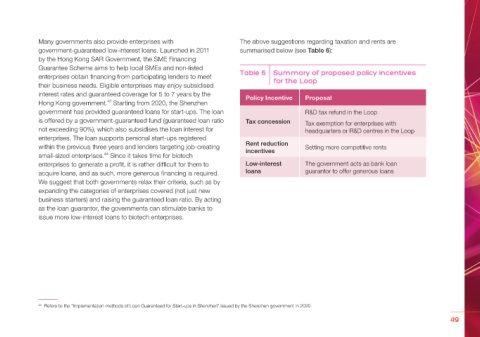

enterprises obtain financing from participating lenders to meet Table 6 Summary of proposed policy incentives

for the Loop

their business needs. Eligible enterprises may enjoy subsidised

interest rates and guaranteed coverage for 5 to 7 years by the Policy Incentive Proposal

43

Hong Kong government. Starting from 2020, the Shenzhen

government has provided guaranteed loans for start-ups. The loan R&D tax refund in the Loop

is offered by a government-guaranteed fund (guaranteed loan ratio Tax concession Tax exemption for enterprises with

not exceeding 90%), which also subsidises the loan interest for headquarters or R&D centres in the Loop

enterprises. The loan supports personal start-ups registered

within the previous three years and lenders targeting job-creating Rent reduction Setting more competitive rents

incentives

44

small-sized enterprises. Since it takes time for biotech

enterprises to generate a profit, it is rather difficult for them to Low-interest The government acts as bank loan

acquire loans, and as such, more generous financing is required. loans guarantor to offer generous loans

We suggest that both governments relax their criteria, such as by

expanding the categories of enterprises covered (not just new

business starters) and raising the guaranteed loan ratio. By acting

as the loan guarantor, the governments can stimulate banks to

issue more low-interest loans to biotech enterprises.

44 Refers to the “Implementation methods of Loan Guaranteed for Start-ups in Shenzhen” issued by the Shenzhen government in 2020.

49