Page 49 - OHKF_Biotech_EN

P. 49

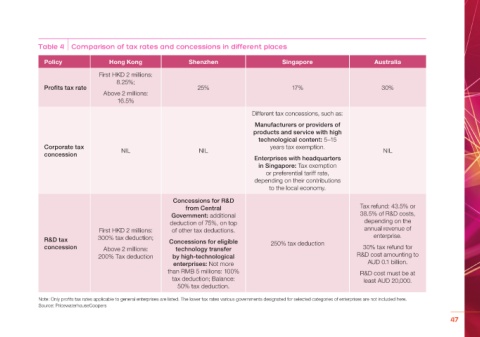

Table 4 Comparison of tax rates and concessions in different places

Policy Hong Kong Shenzhen Singapore Australia

First HKD 2 millions:

8.25%;

Profits tax rate 25% 17% 30%

Above 2 millions:

16.5%

Different tax concessions, such as:

Manufacturers or providers of

products and service with high

technological content: 5–15

Corporate tax NIL NIL years tax exemption. NIL

concession

Enterprises with headquarters

in Singapore: Tax exemption

or preferential tariff rate,

depending on their contributions

to the local economy.

Concessions for R&D

from Central Tax refund: 43.5% or

Government: additional 38.5% of R&D costs,

deduction of 75%, on top depending on the

First HKD 2 millions: of other tax deductions. annual revenue of

R&D tax 300% tax deduction; Concessions for eligible enterprise.

concession Above 2 millions: technology transfer 250% tax deduction 30% tax refund for

200% Tax deduction by high-technological R&D cost amounting to

enterprises: Not more AUD 0.1 billion.

than RMB 5 millions: 100% R&D cost must be at

tax deduction; Balance: least AUD 20,000.

50% tax deduction.

Note: Only profits tax rates applicable to general enterprises are listed. The lower tax rates various governments designated for selected categories of enterprises are not included here.

Source: PricewaterhouseCoopers

47